For Investors.

Financial Models for Investors

We probably don’t need to explain financial models, their use cases, and their workings to you, so we will get straight to the point.

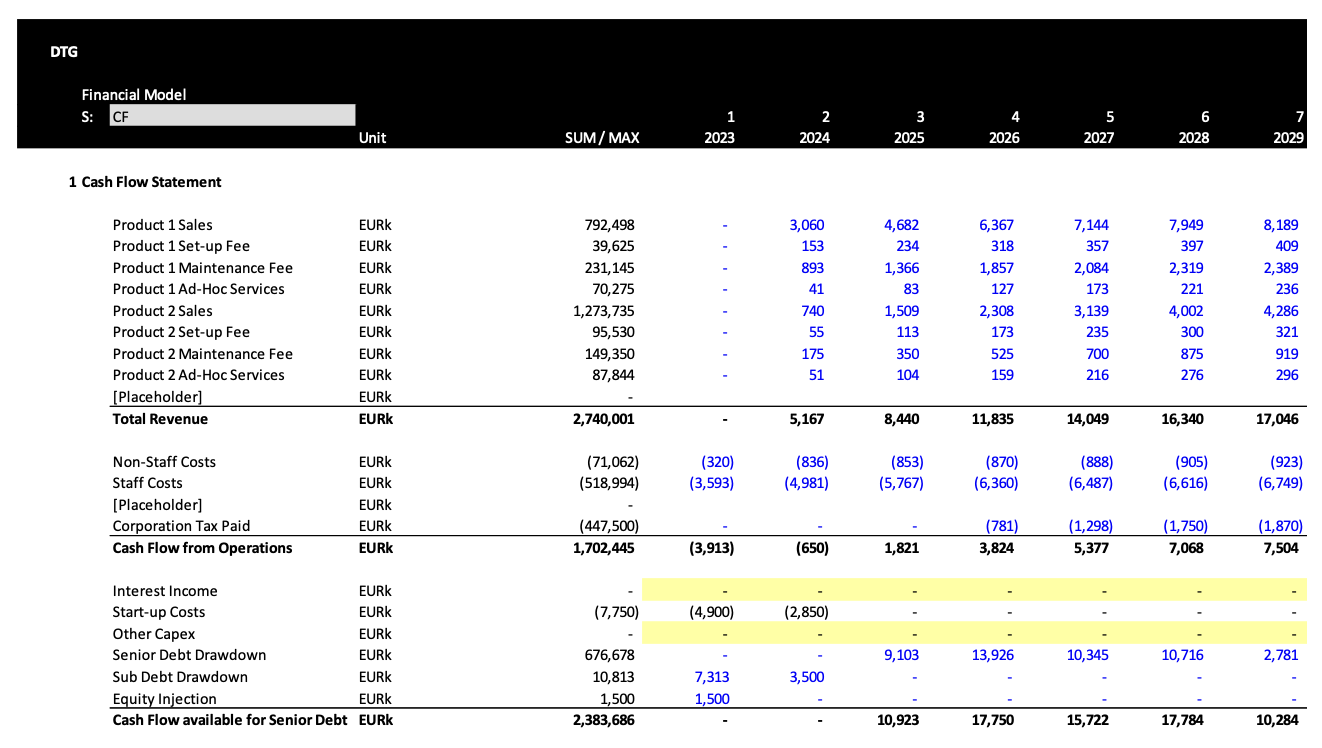

We know financial models inside out and can develop a model tailored to your needs for your transaction. The model will show all market standard KPIs and will accurately reflect the proposed transaction, including complexities (MIP or bespoke transaction structures including earn-outs and ratchet mechanisms).

Naturally, we can also proactively update the model with due diligence findings, so that we can develop a realistic business plan together with you. Sensitivity analysis and the analysis of various scenarios can be integrated into our models in line with your requirements.

Our Services

In terms of financial modelling we can offer you the complete package, including:

- Development of a professional financial model in cooperation with you, your advisors and the management team (as applicable);

- Development of scenario and sensitivity analysis for the most important business plan levers and external factors;

- Running and development of the model during a transaction, including updates in line with due diligence findings;

- Implementation and development of complex transaction structures (e.g. earnout mechanisms);

- Calibration of management incentive plans (on the basis of the model);

- Adaption of the model for post-transaction use cases, e.g. monitoring and reporting;

- Modelling of exit scenarios at the end of the envisaged holding period.

The model will produce the financial statements and outputs you require. We can implement other features, including automisations, e.g. through VBA macros, per your needs.

Contact Us

If you should like to learn more about our financial modelling services, please contact us on kontakt@dtrag.de. We are looking forward to meeting you.